Origins of the Comstock: The Hale and Norcross

The Hale and Norcross Mining Company represented the good and bad of mining ventures. It was a grand success but also the scene of power struggles and fraud against shareholders.

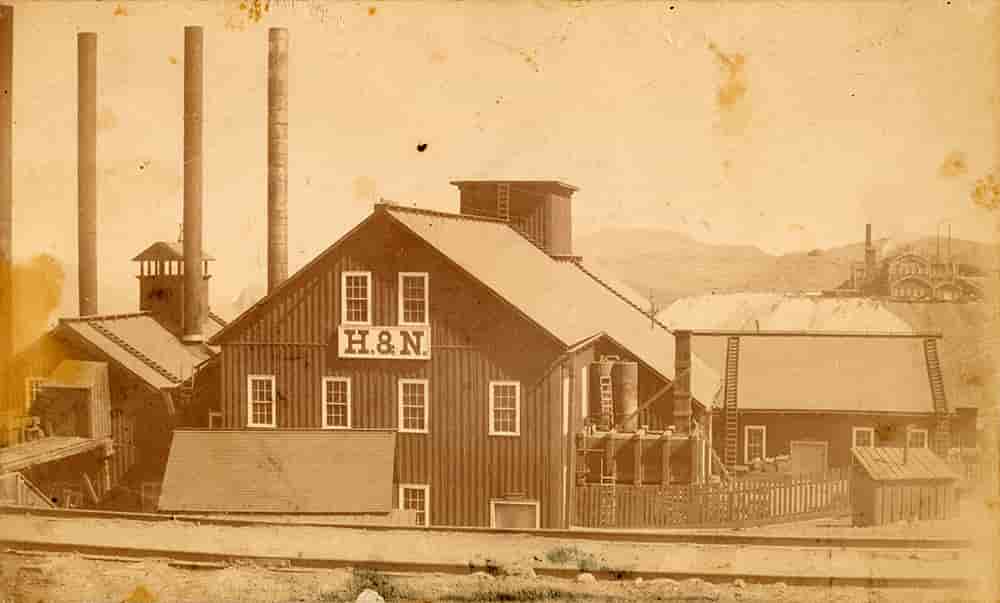

Header Image: The Hale & Norcross Mine hoisting works; courtesy Special Collections Department, University of Nevada, Reno Libraries [1].

“The greatest gold and silver vein ever discovered in human history-The Comstock”

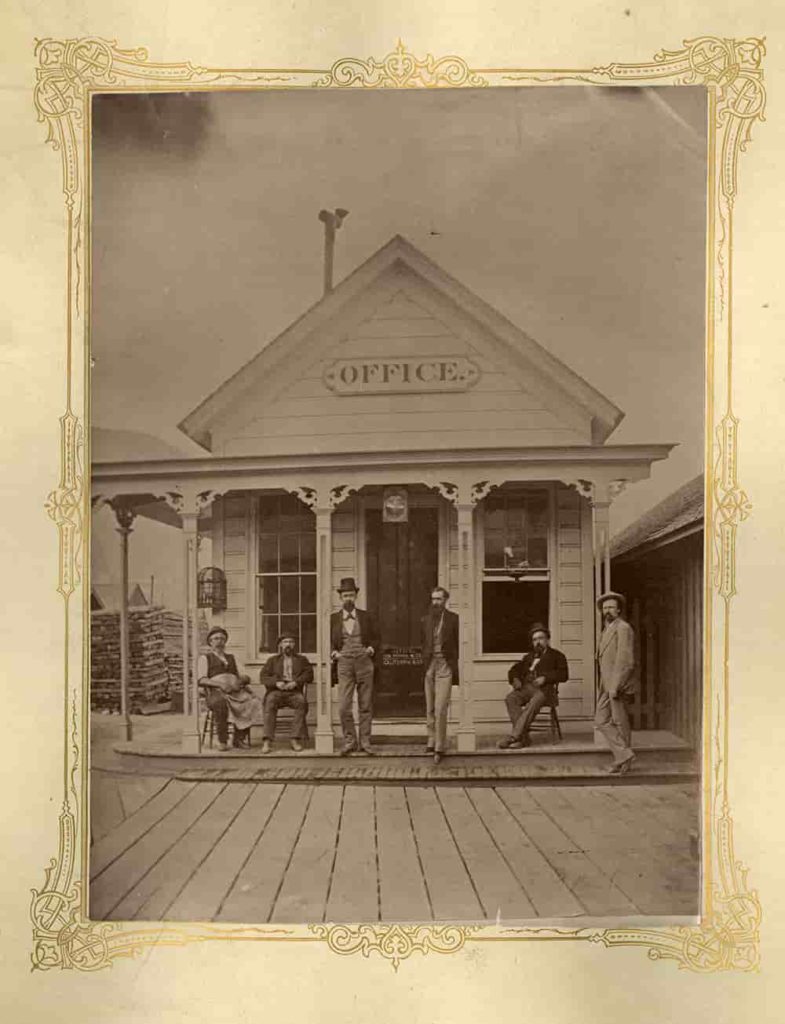

The Consolidated Virginia Mining Company Office in Virginia City represented the evolution of extreme wealth and power of the Bonanza Group; courtesy Special Collections Department, University of Nevada, Reno Libraries

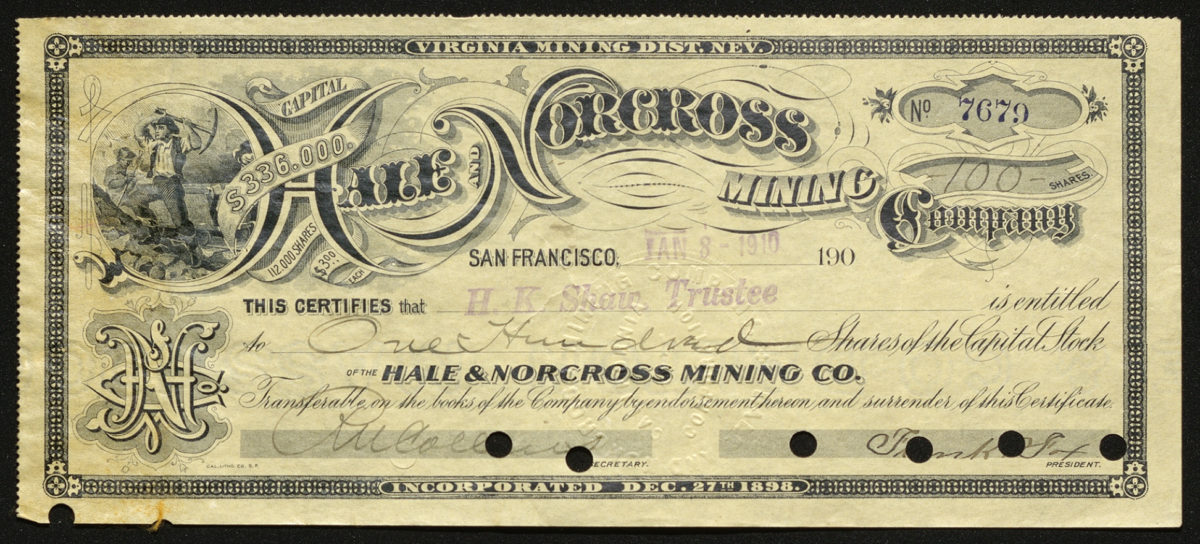

This is a stock certificate for shares in the Hale and Norcross Mining Company, one of the early success stories of the Comstock Lode. The Comstock was one of the most significant silver mining discoveries in American history that propelled Nevada to statehood and the financial center of San Francisco to greatness. The Hale and Norcross was one of the first mines developed in Virginia City in 1860, shortly after the discovery of silver ore in 1859. By 1916, it had produced $12 million in silver.

The story of the Hale & Norcross involves volatile stock markets, conspiracy, and intrigue. The notorious William Sharon, along with representatives of the Bank of California, formed a group called the ‘Bank Crowd’ that financially dominated the Comstock Lode in the 1860s. Sharon, who “could not tolerate… success under his nose but out of his control” (James, 1998, p. 103) took control of the Hale & Norcross in 1868. The Bank Crowd’s aggressive efforts inflated the mine’s stock prices from $1,260 to $7,100 a share in the first two months of the year. The mine was inadequately managed under the Bank Crowd and only produce low-grade ore; by September shares of stock had dipped to $41.50.

Prior to this, in 1867, James Fair had worked as assistant superintendent of the Hale & Norcross. After he was dismissed from this position, he and John W. Mackay entered into business together. When the mine’s stock prices crashed because people feared it was worthless, Fair saw a potential opportunity for fortunes. Fair and Mackay formed a partnership with two other men: William S. O’Brien and James C. Flood. Together the four men came to be known as the Bonanza Group and were strongly allied by the fact they were all Irishmen who had built their reputations and wealth in the mines of the West.

The Bonanza Group began quietly buying up shares of Hale & Norcross stock. When the mining company had a meeting to elect officers in March of 1869, the Bonanza Crowd initiated a hostile take-over. Since they held a majority of the shares, they elected themselves trustees of the company. Flood became president of the Hale & Norcross, and Fair became the mine’s superintendent. These partners led the mine to great successes, and the group leveraged their profits to begin to wrest control of the Comstock away from the Bank Crowd. James Fair went on to become a U.S. senator, while John Mackay used his fortunes to support the establishment of the Mackay School of Mines at the University of Nevada. Part of the Mackay Silver Collection, a custom-made 1,250-piece set of Tiffany silver made of silver ore from the Comstock, is on display at the W.M. Keck Earth Science and Mineral Engineering Museum on the University of Nevada, Reno campus.

In the 1890s, the Hale & Norcross became embroiled in a new scandal when a lawsuit was filed on behalf of stockholders of the company. It was alleged that directors and managers of the mine had entered into a conspiracy, along with a local mill, to misrepresent the wealth of ore from the mine and rob stockholders of their share of over $2 million dollars in profits. Three men—Hayward, Hobart, and Levy—were charged with conspiracy by the Supreme Court. John W. Mackay testified as an expert witness in the case, among other things pointing out that a difference of more than ten percent in value of assays between the mine and the mill was suspicious; the Hale and Norcross had a difference of thirty-five percent. The New York Times noted that “Mackay’s testimony created a sensation, as it is the first time that figures on the cost of Comstock mining have been made public” (1891, p.2).

University of Nevada, Reno

University of Nevada, Reno