The North American Land Company: Robert Morris’ Ruination

After the Revolutionary War, Founding Father Robert Morris put his fortunes into buying plentiful inexpensive land of the United States but lost everything when his North American Land Company became deeply indebted

Header Image: The Apotheosis of Washington depicts the God Mercury giving gold to Robert Morris; author Constantino Brumidi courtesy Wikimedia Commons [1].

“It is the duty of every individual to act his part in whatever station his country may call him to in hours of difficulty, danger, and distress.”

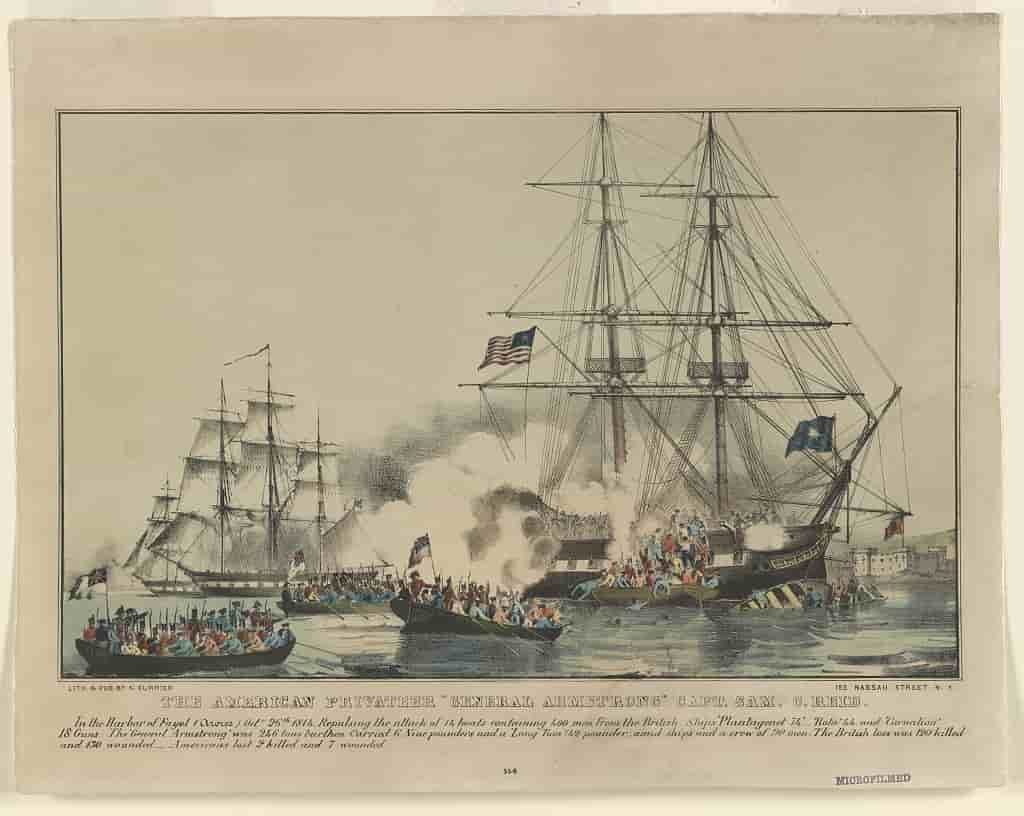

Morris initially made his fortunes by backing privateers, state-sanctioned pirates who attacked the ships of enemy nations; courtesy Library of Congress

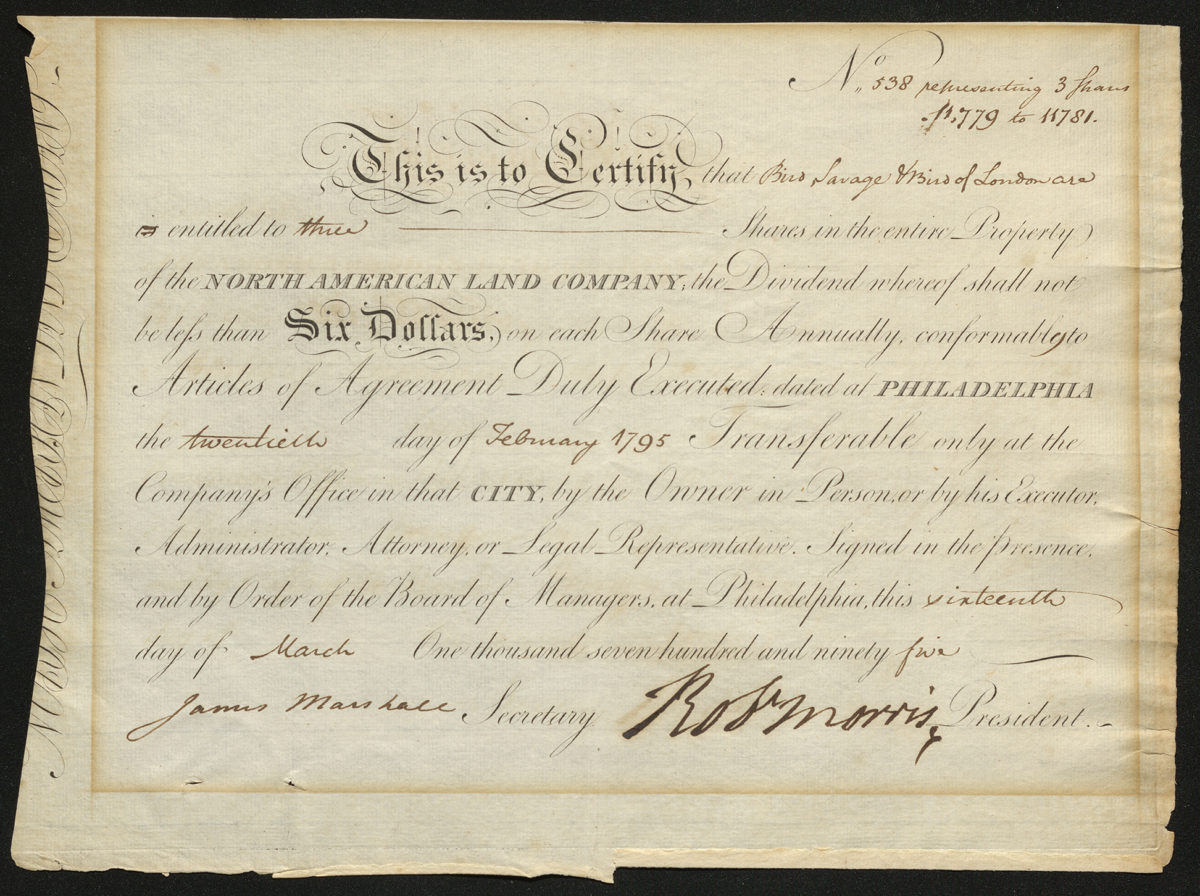

This certificate for stock in the North American Land Company has been signed by the company’s president, Robert Morris. Morris was an American patriot, one of only two men to sign all three founding documents of the United States: the Declaration of Independence, the Articles of Confederation, and the United States Constitution. Morris worked with General George Washington as financier of the American Revolutionary War and played a central role in the establishment of the American financial system after the war.

Washington initially wanted Robert Morris to serve as the country’s first Secretary of the Treasury, but the position was given the Alexander Hamilton after Morris decided to instead serve as a Pennsylvania senator. In 1781, Morris founded the Bank of North America—the first commercial bank in the United States—to help relieve the country’s Revolutionary War debt.

During the revolution, Morris had become the wealthiest man in America through privateering—the state-sanctioned practice of piracy against the ships of enemy nations—as well as insider trading. Following the war, he turned to land speculation, investing in inexpensive land on the American frontier, believing it would increase in value as European migration to the United States grew.

However, this was just the beginning of the first land speculation bubble in the nation’s short history. Robert Morris found himself land-rich with little in liquid assets but doubled down on his speculations by forming the North American Land Company in 1795 with partners John Greenleaf and John Nicholson. The men’s combined land holdings amounted to just over six million acres in Georgia, South Carolina, Virginia, North Carolina, Pennsylvania, and Kentucky (in order of total acres, most to least). (Scroll down to continue reading about the North American Land Company below)

The North American Land Company’s arrangement did little to change Morris’s financial situation. The company tried to raise capital by selling stocks secured by real estate holdings; this certificate is for three shares of that stock. The signature in the left-hand corner of this document belongs to James Marshall, Morris’s son-in-law who served as the company’s secretary. Marshall traveled to Europe to attempt to sell the company’s stock, but it failed to produce any more interest than the land had. The high costs of the Napoleonic Wars put the final nail in the coffin, as European investors could not afford to bail out Morris and the North American Land Company.

Morris attempted to pay creditors with shares of the company’s stock, but by 1798 he was destitute and imprisoned in Philadelphia’s Prune Street Jail for debtors. He died in poverty five years after his release, only bequeathing his descendants a tangle of lawsuits. This stock certificate was never canceled or redeemed, as it became worthless. The merchant bankers Bird, Savage & Bird of London, who purchased a number of the company’s stocks (this certificate included), followed the North American Land Company into bankruptcy in 1803. Supreme Court Chief Justice John Marshall—brother of James Marshall and one of the founders of American constitutional law—presided over the distribution of assets to Bird, Savage & Bird’s creditors.

University of Nevada, Reno

University of Nevada, Reno